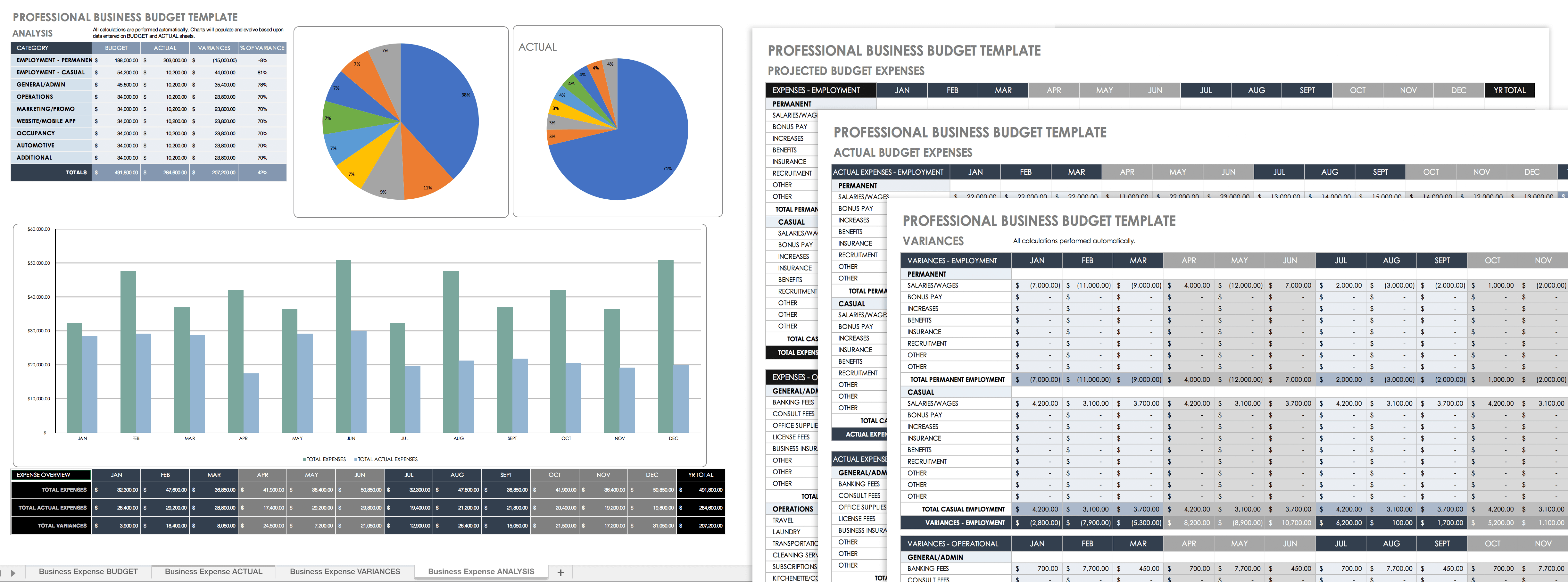

On a budget sheet, you should divide expenses into three categories:įixed costs are the easiest to factor in as they recur at a steady pace and are always the same. Total ExpensesĪs is the case with the revenue, you should make sure you jot down every source of expense so that you have a clear overview of how much money you spend and why. This way, you can prepare for a less fruitful month and cut expenses where possible to be ready for a lower-or negative-profit margin. When you have enough data, you will start to notice patterns-some months are more productive than others. Once you map out all your income streams, you will be able to determine your revenue on a monthly basis. Some of the common income sources include: You need to single out every income source and see how much money your business brings in every month. Revenue represents all the money that enters your company prior to deducting any expenses. If you want your budget to be of any worth, you need to examine these three elements and define them as accurately as possible. The United States Small Business Administration (SBA) determines three major elements of any small business budget:

SMALL BUSINESS BUDGET PLANNING HOW TO

How To Create a Budget for a Small Business See how many sales you need to break even.Make an educated guess on your future earnings.Your budget should not be rigid in its form-it needs to be flexible and accepting of any sudden changes, which happen all the time in a business. Creating a budget for a small business will help you have a clearer view of your financial standing and your progress-or lack thereof. We will also explain how you can increase your funds with small business loans, which you can acquire with ease if you subscribe to DoNotPay.Ī small business budget is a detailed plan that will help you keep track of every dollar that goes in and out of your company. In this article, we will show you how to create a small business budget. To be successful with your business, you need a strategic approach regarding your finances. What they do not consider is the business aspect of it-having to deal with the paperwork, startup costs, and future plans.Īround 20% of all startups go under in the first year, and almost half of the owners state that a lack of funds is the reason for it. Many jump into opening a startup or small business with the idea of having their dream job-doing what they want and being their own boss. Small Business Loan Request Letter The Ins and Outs of Small Business Budget Planning Small Business Budget Planning-All You Should Know

0 kommentar(er)

0 kommentar(er)